College Financial Aid Information

********FAFSA INFO********

The FAFSA will open on October 1, 2025!

What to do NOW to get ready to complete the FAFSA.

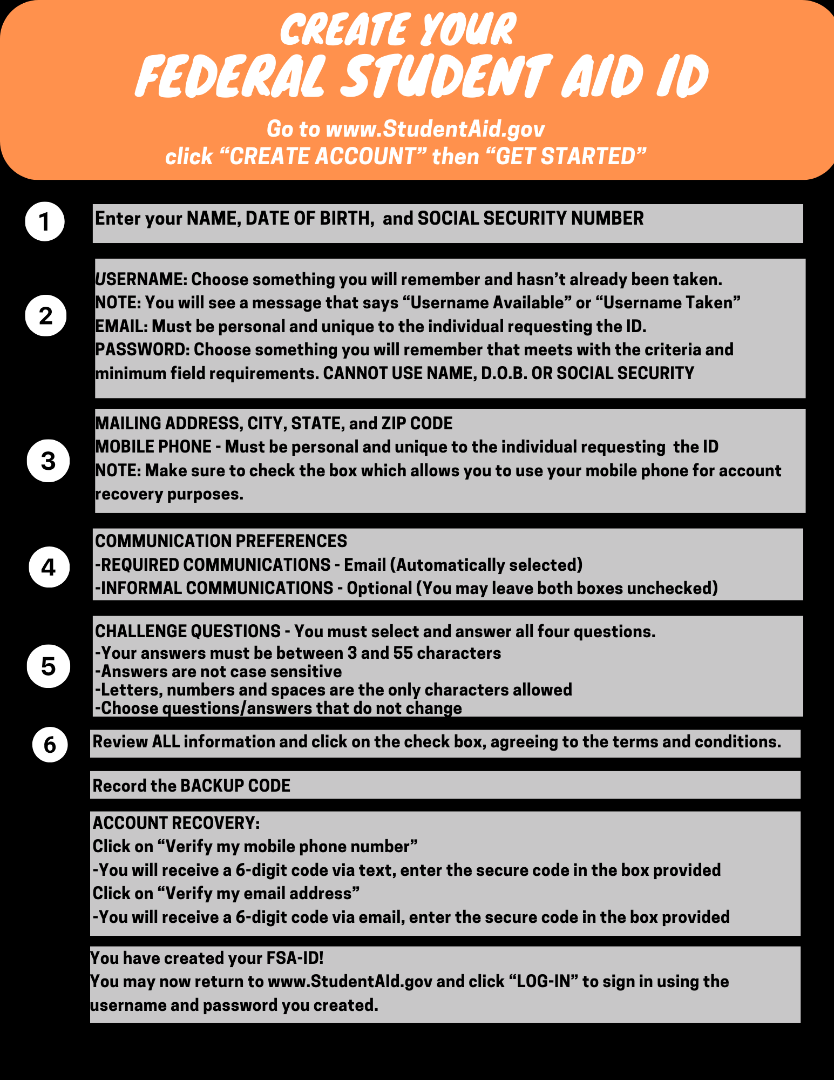

Make sure student and parent each have a separate FSA Id. You will need this to complete/submit the FAFSA.

Financial Aid Information for Seniors and Parents

All college bound students must complete the Free Application for Federal and Student Aid (FAFSA) (State requirement). All colleges and universities require this form to be completed because it is intricately tied to all money your child may receive to go to college, including scholarships. I have provided some basic information for you concerning this process. The only way to opt out of completing the FAFSA (student is NOT planning to attend college) is by filling out a waiver on-line (See your school counselor for information).

When do I apply?

This year the FAFSA will open on October 1st. It is important to complete the FAFSA as soon as possible so your student does not miss out on lucrative scholarships and other monetary awards offered by colleges and the federal government.

How do I begin?

Go to the FAFSA website https://studentaid.gov and read through the information. Then go to the toolbar on the top of the page and click on “Apply for a PIN.” It is usually a good idea for both the student and the parent to have a PIN number. This way both parties can enter information and view the status at any time. The PIN number is a security measure and a requirement for completing the paperwork. After receiving your PIN number, you can do the actual FAFSA worksheet. The information on the website provides step-by-step instructions. If you have the information listed below handy, getting the form completed is fairly simple. You will have to resubmit financial information every year you child is attending college.

What information will I need to do the paperwork?

The FAFSA questions ask for information about you (your name, date of birth, address, etc.) and about your financial situation. Depending on your circumstances (for instance, whether you’re a U.S. citizen or what tax form you used), you might need the following information or documents as you fill out the FAFSA application:

-

Your Social Security number (it’s important that you enter it correctly on the FAFSA form!)

-

Your parents’ Social Security numbers if you are a dependent student

-

Your driver’s license number if you have one

-

Your Alien Registration number if you are not a U.S. citizen

-

Federal tax information, tax documents, or tax returns, including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are a dependent student:

- IRS Form1040

- Foreign tax return or IRS Form 1040-NR

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia, or Palau

-

Records of your untaxed income, such as child support received, interest income, and veterans non-education benefits, for you, and for your parents if you are a dependent student

-

Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate (but not including the home in which you live); and business and farm assets for you and for your parents if you are a dependent student

Keep these records! You may need them again. Do not mail these supporting records to us.

Why am I being asked this information about my finances?

The government has numerous grants, loans and scholarships, and each one has specific criteria students and parents must meet in order to be awarded that money for college. You child’s monetary award provided by the government is based on these financial records. Individual colleges also use this information to award students money to attend their institution based on financial need. The end result of this paperwork is an Estimated Family Income number or EFC number. This number tells the government and the schools how much money your household is able to contribute towards your child’s education. Obviously, a low EFC number is best because that means your child will be awarded more financial aid by the government.

Where else can I go for help?

The FAFSA website has a toll free number to call for help, and the financial aid office at the college your child is planning to attend can also assist you.

FEDERAL STUDENT AID-PAYING FOR COLLEGE